Solve Your Financial Issue

Get Your Loan Approve in Just 30 Minutes (KL & Selangor Area)

- Highest Approval Rate

- 24 Hours Free Online Application

- No Deposit / Procedure Fee / Gurantor

- Repayment Period From 6 to 60 months

Get Your Money on the Same Day You Apply

- Fast Approval 30 Minutes

- Licensed and Approved

Fast Personal Loans for Quick Financial Relief

Secure the Funds You Need, When You Need Them

Sorry. Our Service Not For Business Owner/Tentera/Shopee & Grab Driver/Foreigner

Year of experiance

who we are

Your Reliable Finance Companion

With over 10 years of experience, Instant Finance Solution has been dedicated to providing financial stability to individuals with banking salaries. Our commitment is to serve a diverse clientele with honesty and efficiency, bridging the gap between urgent financial needs and swift solutions.

contact us any time

011-1312 3030

why choose Instant Finance Solution?

Why Choose Our Loan Service?

Rapid Approval Process

Say goodbye to waiting. Our streamlined approval process ensures you get the help you need quickly, so you can focus on your priorities, not paperwork. Often within 60 Minutes.

No Hidden Fees

Transparency is our mantra. Our loans come with clear terms and no hidden surprises, so you know exactly what to expect and can plan accordingly.

Licensing and Legal

We are registered company with the SSM, licensed by the KPKT under the Moneylenders Act 1951, ensuring legal and ethical operations.

Who Benefits from Our Services?

Salaried Employees

Individuals with steady banked salaries look for quick financial solutions when facing unforeseen emergencies.

Working Professionals

Recent graduates or early-career professionals needing initial financial support with hassle-free loan terms.

Middle-Income Households

Need immediate financial aid for family, healthcare, or urgent repairs, but a straightforward and honest lending process.

Urban Dwellers

Residents of metropolitan areas seek quick and accessible financial support to manage their busy lifestyles.

what we offer ?

Loan Made Easy, Dreams Made Real

Personal Loans

Our loan is perfect for employees with a stable income deposited in a bank account and a PERKESO account. Cash salaries are not accepted. Approval is typically within 1 hour.

Balance Transfer

Balance transfers offer financial flexibility and can save on interest, but it’s important to review the terms, fees, and effects on your finances. If you have questions, feel free to ask.

Personal Loans

Our loan is perfect for employees with a stable income deposited in a bank account and a PERKESO account. Cash salaries are not accepted. Approval is typically within 1 hour for eligible applicants. APR capped at 18%.

Business Loan

Our business loan process is simpler than banks, offering up to RM500,000 in funding with flexible repayment terms of up to 60 months. Whether for expansion or other needs, our loan provides the financial support you require.

Balance Transfer

Balance transfers offer financial flexibility and can save on interest, but it’s important to review the terms, fees, and effects on your finances. If you have questions, feel free to ask.

Flexible Repayment Scheme

*We Do Not Accept Cash Salary*

- Approval Rate As High As 99% If You Meet Our Basic Requirement

- Accept Employees With Salary Credited To Bank Account & Hold a PERKESO Account

- Get Money On The Same Day You Apply Without Delay

- Annual interest rate 8% – 18%. Repayment period from 6 months up to 60 months

Exclusive Offers for Our Clients

Low-Interest Rates

Benefit from competitive rates designed to minimize financial strain and maximize affordability.

Priority Support

Our dedicated customer service team is just a message away, ensuring prompt assistance whenever you need it.

Custom Loan Packages

Choose from a variety of loan packages to fit your specific circumstances and financial goals.

Quick Funds Disbursement

Once approved, receive your funds in record time to tackle expenses head-on without unnecessary delays.

we are professional for all your solution

"Their team walked me through every step, ensuring I understood all terms, which gave me confidence to proceed with my loan."

how it works

let us assist you in obtaining your

01

Initially Consulted

Schedule a consultation to discuss your needs and how we can assist you. We are available to speak at your convenience.

02

Document Collection

Gather the Required Documents for Loan Approval

Submitting a complete set of documents upfront will help ensure a smooth and timely loan approval.

03

Evaluation & Approval

After the loan application has been thoroughly reviewed and the supporting documentation has been carefully evaluated. Based on the information provided, we are pleased to approve the loan request.

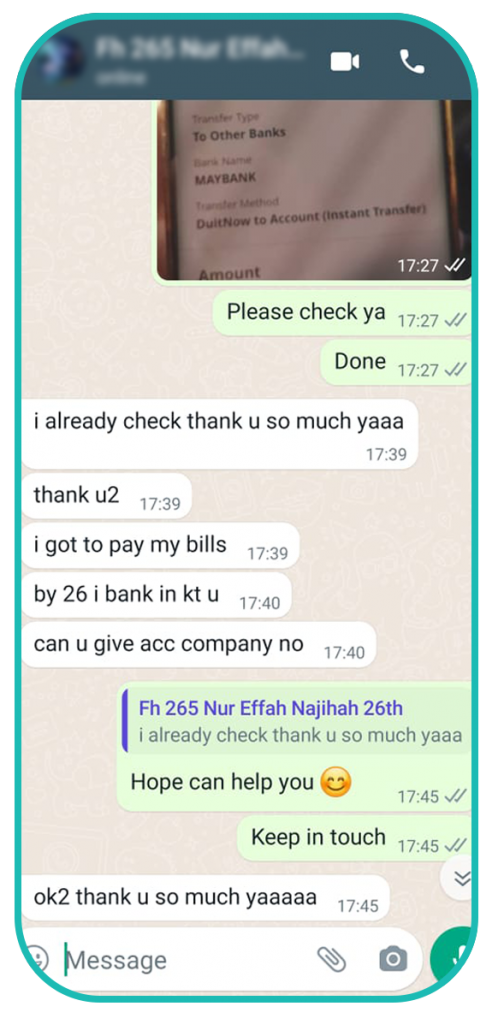

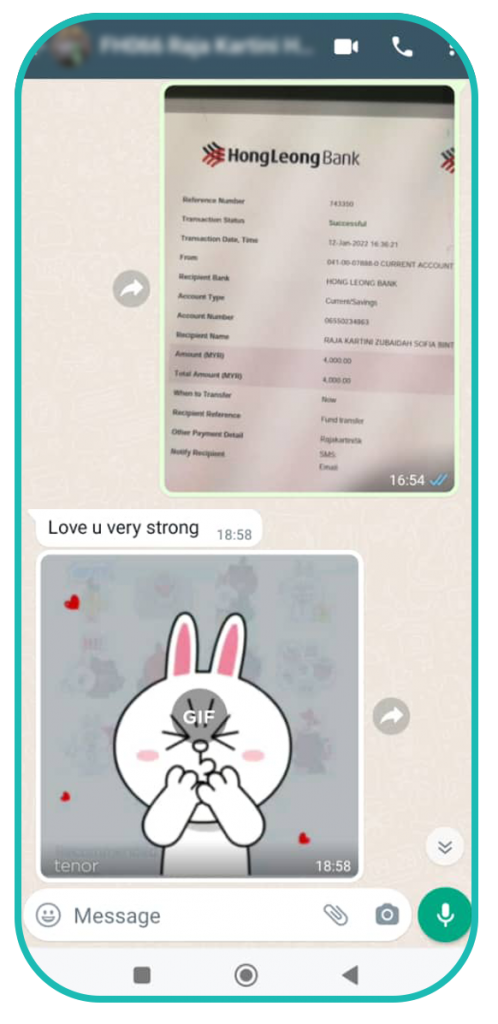

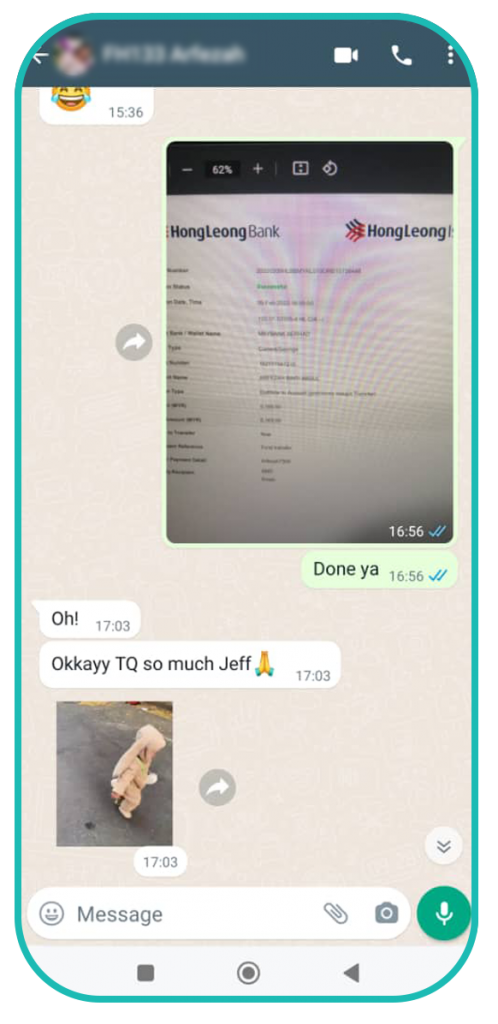

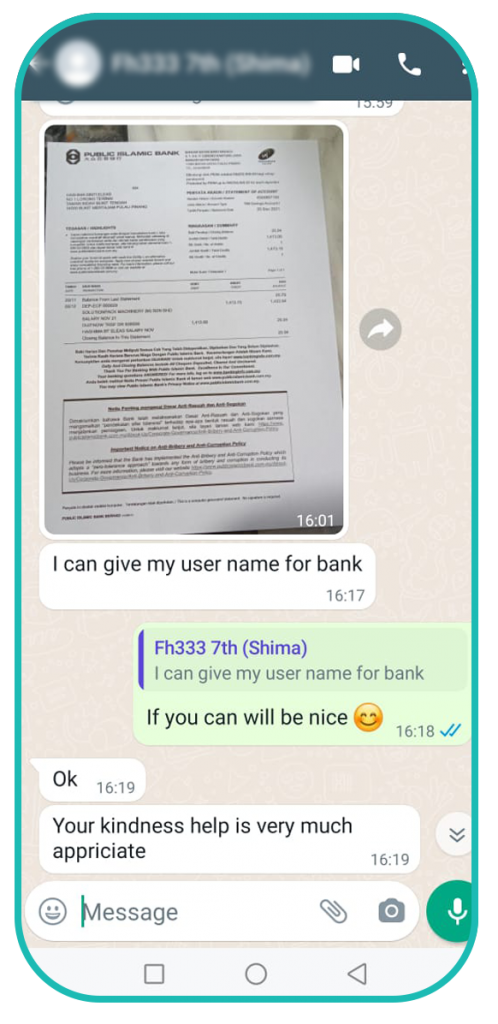

Customers Trust Us

Amount

Success Rate

Years Of Experience

Get Your Money on the Same Day You Apply

Take Charge of Your Finances Today!

Start by calculating the exact amount you need to borrow, making sure it aligns with your repayment capacity. Next, fill out the application form easily found on our website. Finally, upload or send in the necessary documents.

- 3, Jalan Bangsar, KL Eco City, 59200, Kuala Lumpur

- hi@instantsolution4u.com

- Fast Approval 60 Minutes

- Licensed and Approved

Frequently asked question you might have

Choose us for fast approvals, flexible terms, and personalized service, making borrowing a pleasant experience.

Loan disbursement is incredibly quick, delivered within one working day after approval for your immediate financial needs.

Enjoy low-interest rates with Instant Solution, designed to make borrowing affordable and stress-free for all applicants.

Choose repayment terms between 3 and 60 months, allowing customization to suit your financial situation and budget.

Yes, InstantSolution4u is licensed under the Ministry of Housing and Local Government, ensuring reliability and trustworthiness.

frequently asked questions

our most question we had so far

A mortgage is a loan that you take out to finance the purchase of a home. It is a long-term loan typically repaid over several years. The property you purchase serves as collateral for the loan, and if you fail to make the mortgage payments, the lender can foreclose on the property.

Several factors come into play when determining mortgage eligibility. These include your credit score, income, employment history, debt-to-income ratio, and the amount of your down payment. Lenders also consider the property's appraisal value and condition.

A fixed-rate mortgage has a set interest rate that remains unchanged throughout the loan term. This means your monthly mortgage payments will also remain consistent. In contrast, an adjustable-rate mortgage (ARM) offers an initial fixed-rate period, after which the interest rate can fluctuate based on market conditions.

quick info

- 3, Jalan Bangsar, KL Eco City, 59200, Kuala Lumpur

- hi@instantsolution4u.com

Working Hours

Work Hours :

- Mon - Sat : 8am - 6pm

Copyright 2025 © All Right Reserved